The Federal Reserve (Fed) has a history of raising short-term interest rates until something “breaks.” Considering the Fed has raised rates from a near-zero level to 4.75% (upper bound) over the course of only one year, it was almost a near certainty this time would be no different. Recent bank failures suggest things are indeed starting to break. However, we don’t think we’re on the brink of a full-blown crisis, as market indicators we follow suggest contagion risks are still currently low. And while we don’t think a full-blown crisis is imminent, financial stability risks have clearly increased, which makes a prudent asset allocation plan a must.

Contagion

The aftermath of the Silicon Valley Bank (SVB) and other bank failures in the U.S. rippled into Europe last week as Credit Suisse’s (CS) troubles moved firmly into the spotlight. The Swiss bank’s shares slid to an all-time low on Wednesday after the Saudi National Bank (which owns almost 10% of CS) stated it would not provide additional financial support after CS earlier acknowledged “material weakness” in its financial reporting. This followed a series of missteps and compliance issues that have hindered the bank’s global standing in recent years.

Then, on Thursday, the Swiss National Bank (SNB) issued a note aiming to regain confidence in CS, saying they “will provide liquidity to the global active bank if necessary”. Hours later CS announced it had taken the SNB up on this offer and would borrow up to $54 billion (50 billion Swiss Francs) in what the bank called a “decisive action to pre-emptively strengthen its liquidity.” After a week of such high drama, which culminated in UBS’ takeover of Credit Suisse over the weekend, we look at a few key indicators to gauge how various market indicators we watch are reacting to the turmoil in the banking sector.

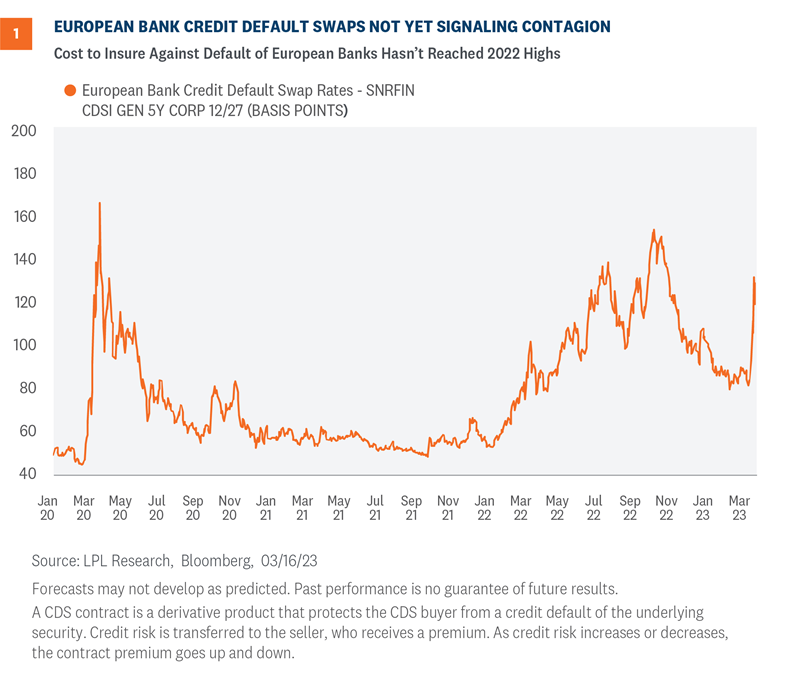

The word at a the top of everyone’s mind at the moment is “contagion”: Will the troubles at SVB, CS, and others spread to the wider banking sector and lead to a 2008-like banking crisis? Credit Default Swaps (CDS), a derivative financial instrument that market participants can use to insure against default, on European banks so far don’t seem to be indicating contagion in the European banking sector (Figure 1). Prior to the UBS tie-up, the CDS on CS may have reached deep distressed levels not seen at a major global bank since the financial crisis, but European bank sector CDS are still below levels seen as recently as fall 2022.

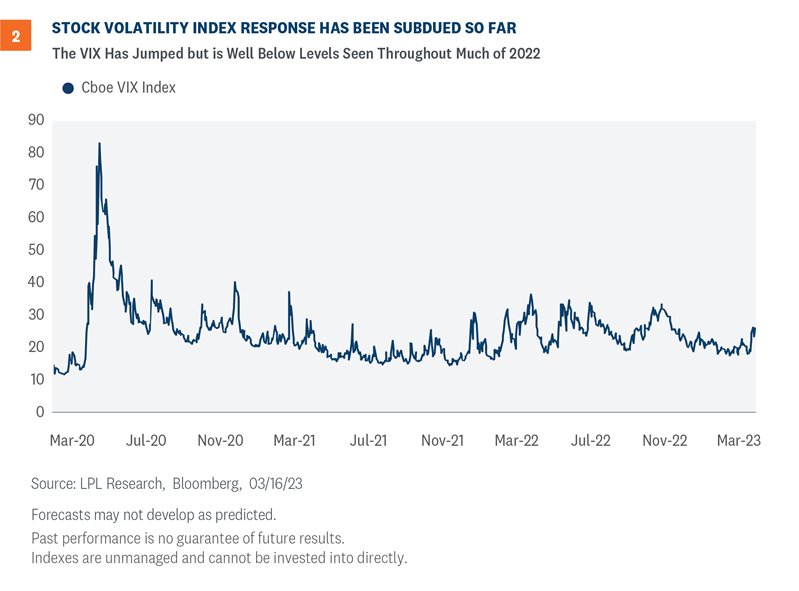

Back to domestic equity markets, the CBOE (Chicago Board Options Exchange) Volatility Index, commonly referred to as the VIX, is sometimes known as the “fear gauge”. Based on the VIX, the response to banking troubles from equity markets has been fairly subdued and certainly hasn’t indicated a wider panic is taking hold in the markets. The VIX is near 25, up around 6 points, or 30%, since the middle of last week, but this level only places it in the top 39% of readings over the last year (although the last year has been abnormally volatile and over the last 10 years the current reading would be in the top 13%) (Figure 2).

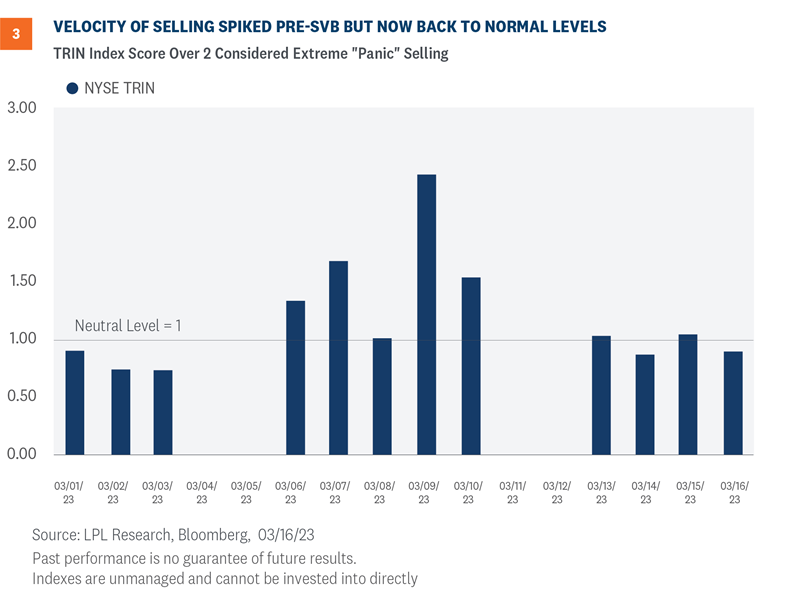

A market sentiment indicator we watch to assess stock selling pressure is the New York Stock Exchange (NYSE) Short Term Trading Index (TRIN), also known as the ARMS index. It is a technical indicator that measures the velocity of trading by looking at advancing/declining volumes and advancing/declining stocks. A TRIN score above 2 can be interpreted as a signal that the velocity of selling is at an extreme, while around 1 is considered neutral. The velocity of selling did spike on Thursday last week, indicating some panic sellers, but since then the TRIN has been at very average levels (Figure 3).

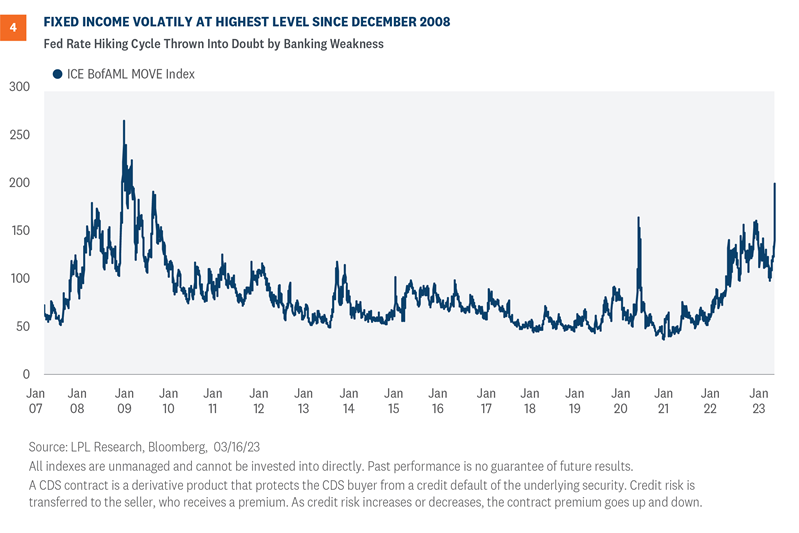

A more extreme signal is coming from the bond markets where the MOVE Index (Merrill Lynch Option Volatility Estimate) is hitting levels not seen since 2008. The MOVE Index tracks the expected volatility of U.S. Treasury yields implied by option prices (much like the VIX does for equities). Generally, the MOVE and VIX tend to be correlated but do diverge significantly at times, as they are now.

Volatility in Treasuries has been rising since the start of 2021 when the bond markets started sniffing out that the Fed may need to take action to tackle rising inflation and has been extremely elevated since the start of 2022. What was already an important rate decision this week has taken on epic proportions since the banking turmoil. Fed Chair Jerome Powell seemed to have opened the door to a 50 basis point (0.5%) hike during his congressional testimony (pre-SVB) and now he is caught in a tough spot between sticking with even a 25 basis point (0.25%) hike or pausing and not hiking at all to help ease stress on the banks. All of this uncertainty has sent the MOVE index skyrocketing (Figure 4).

Other Financial Indicators

The financial indicators listed above are just some of the metrics we use to measure financial market stress. Other, more traditional metrics, such as U.S. high yield corporate credit spreads and the health of the short-term funding markets, also suggest the recent banking challenges are contained. Certainly, this is a highly fluid situation, and we know confidence in the banking system is key in preventing these isolated events from turning into something more systemic, but from our seats, we do not think a banking crisis is imminent.

Asst Allocation Views

It’s easy to forget about long-term investment objectives when markets are fluctuating widely, but it is those moments when sticking to a well thought out plan is most critical. It’s also a reminder why a diversified asset allocation plan is important.

In response to ongoing market volatility, we would consider adding preferred securities exposure to fixed income allocations. At this point, we are taking a wait and see approach on the banks while closely watching the latest developments. The technology sector looks better to us here, while precious metals warrant consideration on the long side.

Our updated thoughts on asset allocation are outlined below.

Equities vs. Fixed Income. LPL Research’s Strategic and Tactical Asset Allocation Committee (STAAC) remains slightly overweight equities after the Committee reduced its suggested equity exposure and moved higher in quality in fixed income about three weeks ago. While we believe investors should react to recent developments in the banking sector with some caution due to ongoing risk of deposit flight, the backstops provided by central banks and bank regulators over the past week have given us confidence the crisis will be contained. But sentiment remains fragile and technical indicators we follow suggest some caution is prudent.

Value vs. Growth. The recent dip in interest rates and our technical analysis work suggest it makes sense to shift some toward growth and get closer to neutral despite above-average valuation discounts on the value side. The Committee now recommends benchmark technology sector exposure.

Small Caps vs. Large Caps. The near-term outlook for small cap stocks is challenged given larger financial sector weights, but the asset class offers compelling valuations, in our view, to support attractive returns over the next 9 to 12 months—our targeted tactical asset allocation time horizon.

Developed International vs. Emerging Markets. European bank stress and a potential flight-to-safety rally in the U.S. dollar create near-term headwinds for developed international equities. The STAAC remains comfortable with its neutral stance, its underweight position in emerging markets equities, and slight overweight for U.S.

Financials Sector. The ongoing fragility of the banking system, coupled with the negative impact on bank profits from these recent events, leaves us neutral on financials for now with a strong preference for high quality. Fundamentals and valuations suggest the insurance industry looks ripe for opportunities.

Commodities. We consider precious metals an attractive opportunity, particularly gold, in this macro environment. Rising recession risks have weighed more heavily on industrial metals and energy, offsetting catalysts from China’s ongoing economic reopening. The technical setup for West Texas Intermediate (WTI) has deteriorated, and we are waiting for more evidence of price stability before making a bullish call on oil.

Fixed Income Positioning. On the fixed income side, the Committee continues to believe a mostly up-in-quality approach makes sense. Core bond sectors (U.S. Treasuries, Agency mortgage-backed securities [MBS], investment grade corporates) offer income potential and provide diversification to equity market stresses. Preferred securities are the only “plus” sector we believe is worth a small allocation due to valuation discounts offered by the ongoing bank health concerns. The STAAC continues to view high-quality core bonds as good diversifiers offering attractive yields in the current environment.

Bottom line, we believe tactical investors should be maintaining their multi-asset allocations at or near benchmark levels with an emphasis on diversification. We continue to monitor bank industry and macro conditions and will communicate any changes to our tactical views as they occur.

George Smith, CFA, Portfolio Strategist, LPL Financial

Jeffrey Buchbinder, CFA, Chief Equity Strategist, LPL Financial